For-Profit Colleges—Students Pay More, Get Less

As the U.S. Department of Education proposes rolling back the Gainful Employment rules regulating for-profit and vocational education programs, accurate estimates of the earnings outcomes and debt incurred by students in these programs are essential for judging the merits of various policy options. Researchers Stephanie Riegg Cellini and Nicholas Turner generated comprehensive new estimates of the labor market outcomes and debt incurred by students in vocational certificate programs in the for-profit sector.

They looked at administrative data from the U.S. Department of Education matched with tax records from the Internal Revenue Service. The data include roughly 14 years of earnings history for more than 800,000 federally aided certificate students, which allowed them to assess the labor market outcomes of a more comprehensive set of students over a longer time period than prior research.

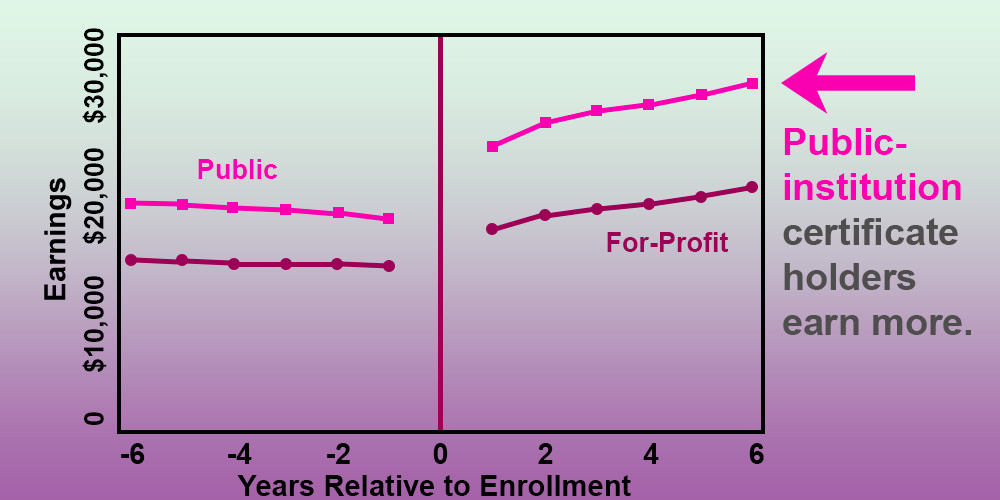

They compared for-profit students’ outcomes with the outcomes of demographically similar students in public sector programs, and with similar individuals who did not pursue any postsecondary education.

They found for-profit students pay more and get less. For-profit students have higher debt and lower earnings gains relative to students who attend public institutions. In fact, the combination of high debt and low earnings effects is so prevalent that many for-profit students are worse off relative to similar individuals who do not attend college at all.

According to the authors, “These results suggest that the Department of Education’s recent proposals to weaken accountability under GE are misguided. Instead, the findings support calls for stronger accountability measures to ensure that for-profit students generate sufficient earnings to cover the high cost of their education.”

Read the full study in the Journal of Human Resources: “Gainfully Employed: Assessing the Employment and Earnings of For-Profit College Students Using Administrative Data,” by Stephanie Cellini and Nicholas Turner.

***

Stephanie Riegg Cellini is an associate professor of public policy and economics at George Washington University and a research associate at the National Bureau of Economic Research. Nicholas Turner is a senior economist at the Federal Reserve Board of Governors. He previously worked in the Office of Tax Analysis at the U.S. Treasury, where this work was completed.